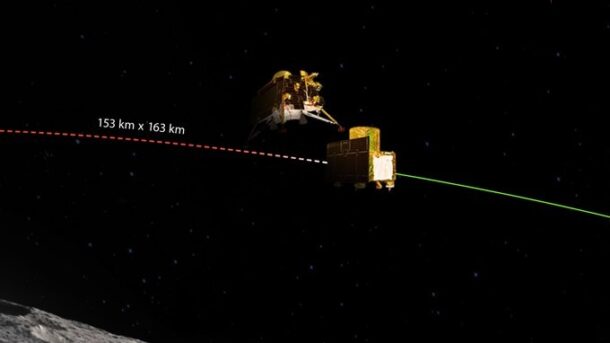

टेन न्यूज नेटवर्क नई दिल्ली (23 अगस्त 2023): चंद्रयान -3 इतिहास बनाने से अब महज कुछ घंटे ही दूर है। 40 दिनों की लंबी यात्रा के...

Continue reading...दिल्ली एयरपोर्ट पर टला बड़ा हादसा: एक ही समय पर दो विमानों को मिली टेकऑफ और लैंडिंग की अनुमति

टेन न्यूज नेटवर्क नई दिल्ली (23 अगस्त 2023): दिल्ली हवाईअड्डे पर बुधवार सुबह एक बड़ा हादसा टल गया क्योंकि विस्तारा एयरलाइंस के एक विमान को उड़ान...

Continue reading...दिल्ली: 15 साल की नाबालिग लड़की से रेप, DCW अध्यक्ष स्वाति मालीवाल ने पुलिस को जारी किया नोटिस

टेन न्यूज नेटवर्क नई दिल्ली (23 अगस्त 2023): राष्ट्रीय राजधानी दिल्ली में 15 साल की लड़की से रेप का मामला सामने आया है। इस मामले में...

Continue reading...बंगला साहिब गुरुद्वारा में केंद्रीय मंत्री हरदीप सिंह पुरी ने टेका मत्था, चंद्रयान-3 की सफल लैंडिंग के लिए मांगी दुआएं

टेन न्यूज नेटवर्क नई दिल्ली (23 अगस्त 2023): चंद्रयान-3 के सफल लैंडिंग को लेकर देशभर के अलग- अलग मंदिरों, मस्जिदों और गुरुद्वारों में पूजा अर्चना एवं...

Continue reading...नाबालिग से रेप मामले में अधिकारी और उसकी पत्नी को कोर्ट ने 14 दिन की न्यायिक हिरासत में भेजा

टेन न्यूज नेटवर्क नई दिल्ली (23 अगस्त 2023): दिल्ली सरकार के एक आधिकारी द्वारा मित्र की नाबालिग बेटी से बलात्कार के मामले में आरोपी अधिकारी प्रेमोदय...

Continue reading...राजधानी दिल्ली में G20 की बैठक, सरकारी दफ्तर से लेकर स्कूल -कॉलेज रहेंगे बंद

टेन न्यूज नेटवर्क नई दिल्ली (23 अगस्त 2023): राष्ट्रीय राजधानी दिल्ली में G20 की बैठक आयोजित होगी। इस बाबत राजधानी में सुरक्षा व्यवस्था सहित सभी अन्य...

Continue reading...कर लो चांद मुट्ठी में: चंद्रमा की ओर यात्रा पर चंद्रयान -3 | जानें पूरी डिटेल्स

टेन न्यूज नेटवर्क नई दिल्ली (23 अगस्त 2023): अंतरिक्ष में भारत की बादशाहत बरकरार है। भारत एकबार फिर कीर्तिमान रचने जा रहा है, बस कुछ ही...

Continue reading...चंद्रयान-3 मिशन पर अंतरिक्ष रणनीतिकार पी.के. घोष ने क्या कहा

टेन न्यूज नेटवर्क नई दिल्ली (23 अगस्त 2023): रूस के मून मिशन लूना-25 के फेल होने के बाद अब सारी दुनिया की निगाहें भारत के चंद्रयान-3...

Continue reading...Under construction railway over bridge at Sairang near Aizawl collapses; Mizoram CM tweets, “At least 17 workers died”

Under construction railway over bridge at Sairang near Aizawl collapses; Mizoram CM tweets, “At least 17 workers died”

Continue reading...चंद्रयान-3 की सफल लैंडिंग के लिए कहीं हवन तो कहीं मांगी जा रही दुआएं

टेन न्यूज नेटवर्क नई दिल्ली (23 अगस्त 2023): रूस के मून मिशन लूना-25 के फेल होने के बाद अब सारी दुनिया की निगाहें भारत के चंद्रयान-3...

Continue reading...