टेन न्यूज नेटवर्क नई दिल्ली (19 अप्रैल 2024): दिल्ली में लोकसभा चुनाव 2024 के लिए पार्टियों ने अपने प्रचार-प्रसार में पूरी ताकत झोंक दी है। बीजेपी...

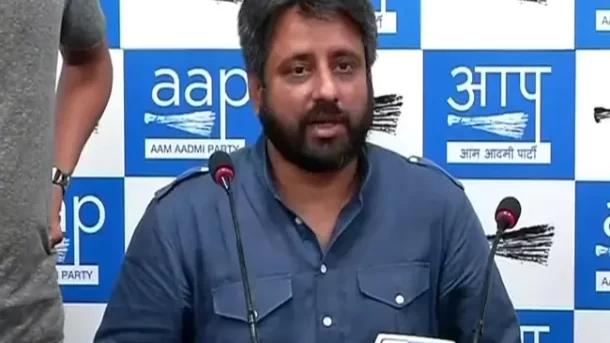

Continue reading...बड़ी खबर: AAP के एक और विधायक को ED ने किया गिरफ्तार, जानें पूरा मामला

टेन न्यूज नेटवर्क नई दिल्ली (18 अप्रैल 2024) राजधानी दिल्ली से इस वक्त की बड़ी खबर सामने आ रही है,आम आदमी पार्टी के एक और विधायक...

Continue reading...दिल्ली का मेयर चुनाव हुआ दिलचस्प, आप और बीजेपी के प्रत्याशियों ने किया नामांकन

टेन न्यूज नेटवर्क नई दिल्ली (18 अप्रैल 2024): आम आदमी पार्टी ने इस साल नए MCD मेयर के लिए महेश खिची को अपना उम्मीदवार घोषित किया...

Continue reading...मेयर के लिए महेश खींची और डिप्टी मेयर के लिए रविंद्र भारद्वाज बने उम्मीदवार

टेन न्यूज नेटवर्क नई दिल्ली (18 अप्रैल 2024): आम आदमी पार्टी ने इस साल नए MCD मेयर के लिए महेश खिची को अपना उम्मीदवार घोषित किया।...

Continue reading...शक्ति मंदिर संत नगर में भव्य नवरात्रि समारोह का आयोजन

सर्वेश्वर सर्वेश पाठक टेन न्यूज नेटवर्क नई दिल्ली (18 अप्रैल 2024): दक्षिणी दिल्ली के संत नगर में स्थित शक्ति मंदिर अपने अस्तित्व के पिछले कई वर्षों...

Continue reading...सम्पूर्ण रामायण पर आधारित विश्व की पहली पेंटिंग को चित्रकार ने राम मंदिर को किया समर्पित

टेन न्यूज नेटवर्क नई दिल्ली (18 अप्रैल 2024): रामनवमी के मौके पर विश्व हिंदू परिषद के अंतरराष्ट्रीय अध्यक्ष आलोक कुमार ने दिल्ली के जाने-माने पेंटर महेश...

Continue reading...भाजपा नेताओं ने प्रेस कांफ्रेंस के माध्यम से आम आदमी पार्टी पर बोला जोरदार हमला

टेन न्यूज नेटवर्क नई दिल्ली (17 अप्रैल 2024): दिल्ली भाजपा के अध्यक्ष वीरेन्द्र सचदेवा ने प्रेस कांफ्रेंस को संबोधित करते हुए कहा कि अरविंद केजरीवाल के...

Continue reading...आम आदमी पार्टी ने लॉन्च किया ‘AAP का रामराज्य’ वेबसाइट, लोकसभा चुनाव प्रचार अभियान की शुरुआत

रंजन अभिषेक, संवाददाता टेन न्यूज नेटवर्क नई दिल्ली (17 अप्रैल 2024): आम आदमी पार्टी ने सांसद संजय सिंह, आप नेता आतिशी, सौरभ भारद्वाज, जैस्मिन शाह की मौजूदगी...

Continue reading...UPSC CSE 2023: 26 वीं रैंक हासिल करने वाली रूपल राणा की संघर्ष की कहानी, टेन न्यूज की विशेष रिपोर्ट

टेन न्यूज नेटवर्क नई दिल्ली (16 अप्रैल 2024) यूपीएससी सिविल सेवा परीक्षा में सफलता पाने वाले लोगों के संघर्ष की कहानी हर किसी के लिए प्रेरणा...

Continue reading...छत्तीसगढ़ में सुरक्षा बलों को मिली बड़ी कामयाबी, 29 नक्सली ढेर

टेन न्यूज नेटवर्क नई दिल्ली (16 अप्रैल 2024) छत्तीसगढ़ के कांकेर जिले में चल रही मुठभेड़ में सुरक्षा बलों को बड़ी कामयाबी मिली है। इस मुठभेड़...

Continue reading...